I want to talk to you briefly about the Volume Profile, its origins, what’s the deal with it, and why it’s crucial. This is my favorite topic and the method that I use the most in trading. We will look at the main issues traders have with this method. Why they try it for a while, say it doesn’t work for them or don’t get it. Also why they give up so easily on it, and more. Okay, let’s jump straight to it.

Volume Profiling History

Learning about the history of the Volume Profile is unnecessary and will not help you, but it’s still interesting.

Everything that we know about it today it’s taken from the Market Profile theory of Peter Steidlmayer. He was trying to develop a way to determine and evaluate market value as it developed in the daily time frame.

Everything that you will read and learn about the volume profile is built upon the work that Steidlmayer started. That’s why it’s important we give a nod to him here since he literally came up with this great idea from scratch.

What I’ve done with Volume Profile is that I’ve taken things that I have learned and use them as they were. And in some cases, that works great. However in some other situations, I have taken them and made them more current with small changes.

I fixed them in a way that I wanted to go better with my trading style, and I know exactly what I’m doing.

These specific things that I have developed were because of my observations that are completely original thoughts of mine.

And to take an idea and to truly personalize it and make it better, to do improvements and add your ideas is really difficult. It takes a lot of effort and time and it takes also a lot of competence.

Even though I don’t use Market Profile, it’s still the main reason the Volume Profile evolved and got where it is now.

I have to be grateful to Peter Steidlmayer because I wouldn’t be able to do trading like this, my full-time job, without his idea.

What’s the Deal with Volume Profile?

Let’s get one thing out of the way in the beginning. Volume Profile is not an indicator that you put on your charts and look at what it says. This isn’t the same as if you were looking at the Bollinger bands or the RSI charts, the Volume Profile is not an indicator.

First, you need to understand how an indicator works to see the difference with the volume profile. What indicators do is they take the latest value of the product, which is the latest candle, and they put that value into an equation that later tells you the result in the form of a bar or a dash.

What is the Volume Profile Method?

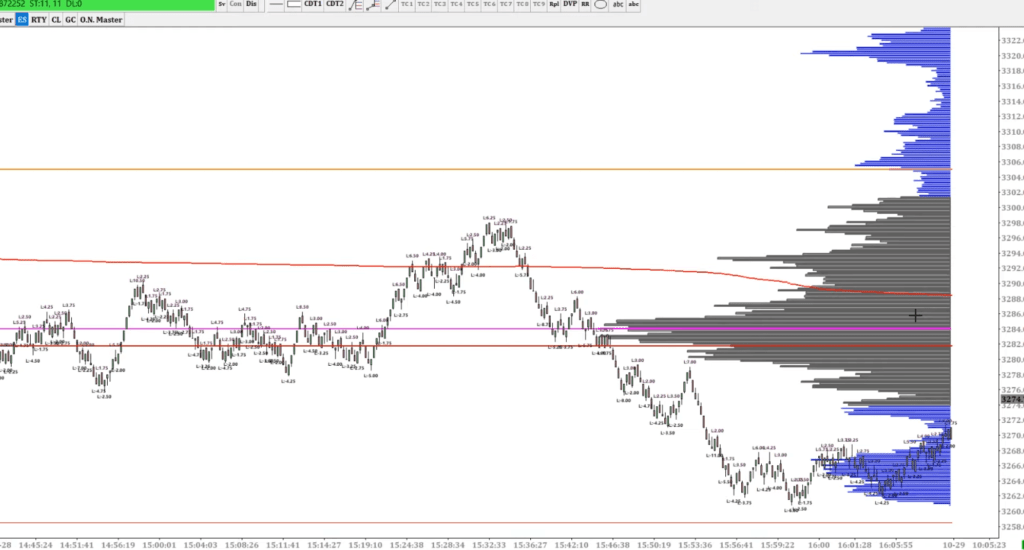

The Volume Profile is looking at the real-time market generated information, it’s not taking information that has already happened, put it in an equation and direct you in a certain way. It generates real-time market information that’s extremely raw and very useful. And it displays that information in a unique way that helps you when trading a lot.

Understanding the information displayed to you from the profile method will help you understand what is going on behind the candles. It’s a more accurate way of plotting out what exactly is happening and what the market is doing.

Why is Understanding How to Read the Volume Profile Important?

Understanding how to read the volume profile, it’s essential because when you know how to do that, you’re going to be in a position where you can create a high-quality trade idea. And this is what differentiates pro traders from somebody that’s just struggling and cannot make it in this industry.

A pro trader knows and has the skill and ability to create a high-quality trade idea, then uses the indicators to help support that idea or to help improve the entry point. Or maybe it doesn’t even use indicators at all, which I do myself.

And if this has been your trading experience, you pull your charts, and you are solely focused on your indicator combos and having them as the primary source of trade ideas. You will not go far, and I’m not trying to be judgmental here, but that’s how I started, too, and I know this issue first hand. This method is not going to earn you consistent money, and you will definitively be struggling.

There’s a big difference between technical analysis and trading, and if you’re only relying on the indicators for your trades, you are missing out on a huge part of trading. Trading this way will only gain you technical analysis skills, which is really not a bad thing, but there’s a crucial piece of information missing.

The Main Issues People have with Volume Profile

One of the first things and maybe one of the biggest things that stop people from learning the profile is looking at it and mistaking the learning curve for being too complicated. If you want to learn the volume profile and you are used to looking at the Bollinger bands, moving averages, and RSI, they all have a similar feel, but Volume Profile is completely different.

As you look at it, the Volume Profile is very different, and it’s easy to look at this and think this is too complicated and go back and do something else. This is a huge mistake because once you get over the learning curve, you have learned an incredible skill to help you in your trading quite a lot.

The Volume Profile is not like other things you’ve probably used. There is a time where you’re going to have to memorize some things, and you’re going to build up a certain level of competence. If you stick with it, you will find that the profile is not complicated and actually simplistic.

The second most important issue for people that start to learn it then leave it all together is because they learn the basics only. They learn the basics and think they know how the profile works. But there’s a huge gap between the basics and how to use the information that you get back.

Closing Thoughts

I’ve been working with volume profile for years now. And I encourage you to try and find information on it that will actually help you close out a trade. After all the reading and information gathering you will do. You will think to yourself how to use what you learned to make money trading. Because that kind of information is not out there for free. But with the right coaching and mentor, you will understand what you are seeing and why to make a move.

I would really suggest it if you are serious about trading since this kind of information is not out there. If you don’t believe me, I encourage you to do broad research. I guarantee nothing will tell you when and why to make a move better than a person that has dedicated his entire life to learning and perfecting the method.

If you liked this article, check out our in-depth free training here.

TradingView Tutorial for setting up the Volume Profile

Watch Your Risk & Happy Trading!

-Korbs

Volume Profile Frequently Asked Questions (FAQ)

How to Read the Volume Profile?

What volume profile does is gather the total traded volume at specific price levels for a specified timeframe. It divides the volume into either buy volume or sell volume. That’s the easiest way you can read the Volume Profile.

Is Volume Profile Worth it?

Volume Profile is a really powerful tool that helps traders determine the price levels. If you understand it and know the strategies behind it then this is an amazing tool to have.

What is the Point of Control in Volume Profile?

The point of Control or POC, is the line where the highest volume was traded. That’s why it has the longest bar when looking at the volume profile. POC is usually used as a support and/or resistance level, ocasionally it can serve as a retest point.