Everything that has to do with the Volume Profile trading is based on Auction Market Theory. This is a topic that almost everyone complicates more than it should be, but I will explain it to you in a simple yet high-level way.

Complex theories must be explained in an uncomplicated and easy-to-understand way so that more people can understand them fully, regardless of what you are trading, whether it futures or market profile, being able to understand the auction market theory will make a better trader.

What is Auction Market Theory?

It’s the understanding that the market is a giant auction.

Market auction theory is based on the assumption that something will fall into balance or what is known as the ‘fair price,’ which is the area where the buyers will generally buy, and the sellers will generally sell. This way, you can see if the price ‘makes sense’ based on prior prices and the available information.

When looking at the price moving up and down you need to understand that it’s not a random thing but it’s a tool that advertises value.

The market is always moving between two states balance and imbalance.

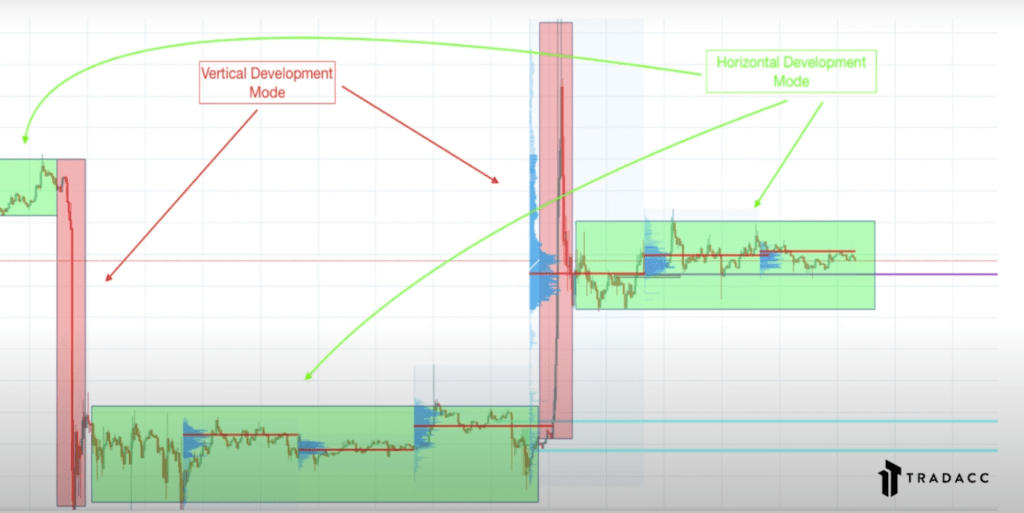

When it’s in balance we see horizontal development, that means that the traders generally agree on the price and trade on it.

When the market loses efficiency and there’s an imbalance, the market changes to vertical development. This means that the market automatically goes into price discovery mode, and it’s on the lookout for the next area of balance.

Why is Auction Market Theory Important?

One of the most important things that you will understand when learning about auction market theory is that it will remove the haze from your eyes.

Where all the other traders look at the charts and see only chaos and confusion, you will be able to see the path clearly.

Looking at the graphs after you have learned about auction market theory will make you able to see the structure and the order that’s there.

Remember that The Market CAN Be Predictable if you have the right tools and knowledge at you disposal.

Understanding the auction market theory will make you understand when the market is in price discovery mode or if it has achieved an area of balance. And that will help you put together a lot.

This information that I’m telling you it’s not something proprietary, this has been around for a long time. You have to look at the right places and find the right books. For example, Peter Steidlmayer has many books that will help you get more in-depth and get all the information you need to know.

However, some things are proprietary to me where I have taken these lessons about the profile and have come up with new ones. You can’t find them anywhere because I literally made them.

But, like I mentioned above you will find everything you need from a Steidlmayer book.

If you liked this article, check out our in-depth free training here.

TradingView Tutorial for setting up the Volume Profile

Watch Your Risk & Happy Trading!

-Korbs

Auction Market Theory Frequently Asked Questions (FAQ)

What is The Auction Market Theory?

The Auction Market Theory is a philosophy of observing the financial markets. And understanding that the market is a giant auction. Basically, it explains that the price and value are distinct from one another.

What Is The Importance of Market Profile?

A market profile makes it easier for the trader to get valuable information and insights for the traded commodity. Find out the competitor’s plans, and what the market trends are looking like. Doing a market analysis is crucial when making business decisions.

What is the goal of a Market Analysis?

The main objective of a market analysis is determining if a market is worth it to invest in. Being able to understand the opportunities and threats it opposes. And see if matches well with the strength and weaknesses of the company.